Ichimoku Kinko Hyo for NinjaTrader 7

Part of the Moving Average Pro Indicator

The goal of this system is to give you information about:

- Sentiment

- Momentum

- Strength of Trend

It also gives a quick indication if price is in relative equilibrium or disequilibrium.

This trading system was developed by a Japanese man named Goichi Hosoda. He named it “Ichimoku Kinko Hyo”, which translates to “Equilibrium chart at a glance”. This appropriately describes the system and how it is to be used.

This indicator is built into the Moving Average Pro indicator. As with all our indicators, colors and appearance are highly customizable!

Purchase The Moving Average Pro for NinjaTrader 7

Looking for Ichimoku Kinko Hyo NinjaTrader 8?

We offer Ichimoku Kinko Hyo for both NinjaTrader 7 & 8.

Ichimoku Kinko Hyo NinjaTrader 8How Do I Enable Ichimoku Kinko Hyo in the Indicator?

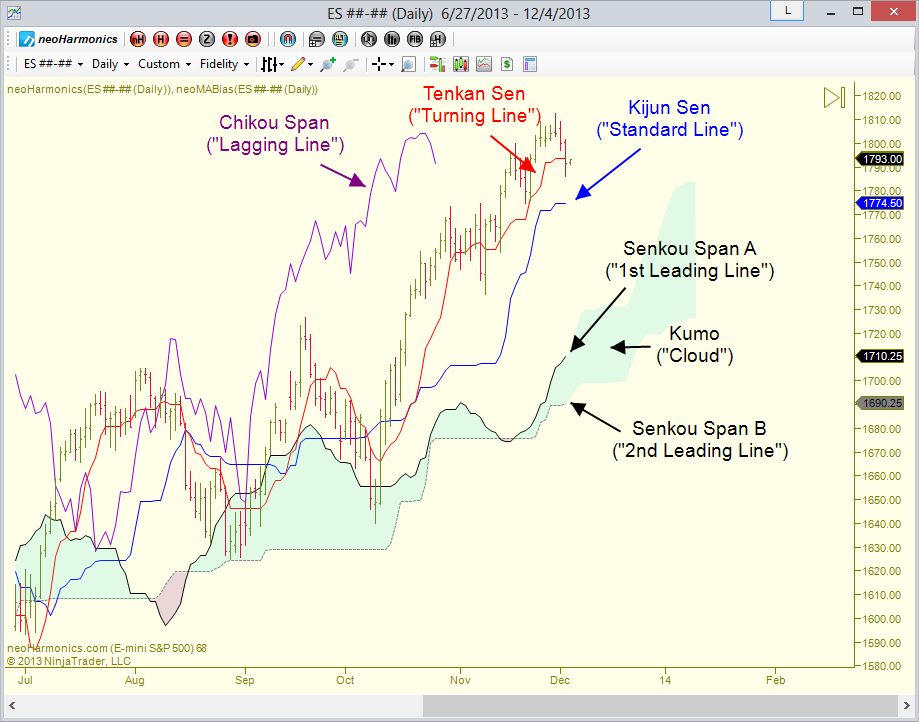

This system contains five components, meant to be used in conjunction with each other.

- Tenkan Sen (“Turning Line”, Red) – (Highest High + Lowest Low) / 2 of the last 9 periods

- Kijun Sen (“Standard Line”, Blue) – (Highest High + Lowest Low) / 2 of the last 26 periods

- Chikou Span (“Lagging Line”, Purple) – Current Closing Price, time-shifted into the past 26 periods

- Senkou Span A (“1st leading Line”) – (Tenkan Sen + Kijun Sen) / 2, time-shifted into the future 26 periods

- Senkou Span B (“2nd leading Line”) – (Highest High + Lowest Low) / 2, of the last 52 periods, time-shifted into the future 26 periods

The 1st and 2nd leading lines (Senkou Span A and B) create the Kumo or “cloud”.

The default settings are 9, 26 and 52. These numbers were derived from the standard Japanese business month (26, including Saturdays). The number 9 represents a week and a half. Finally, the number 52 represents two months (26 times 2).

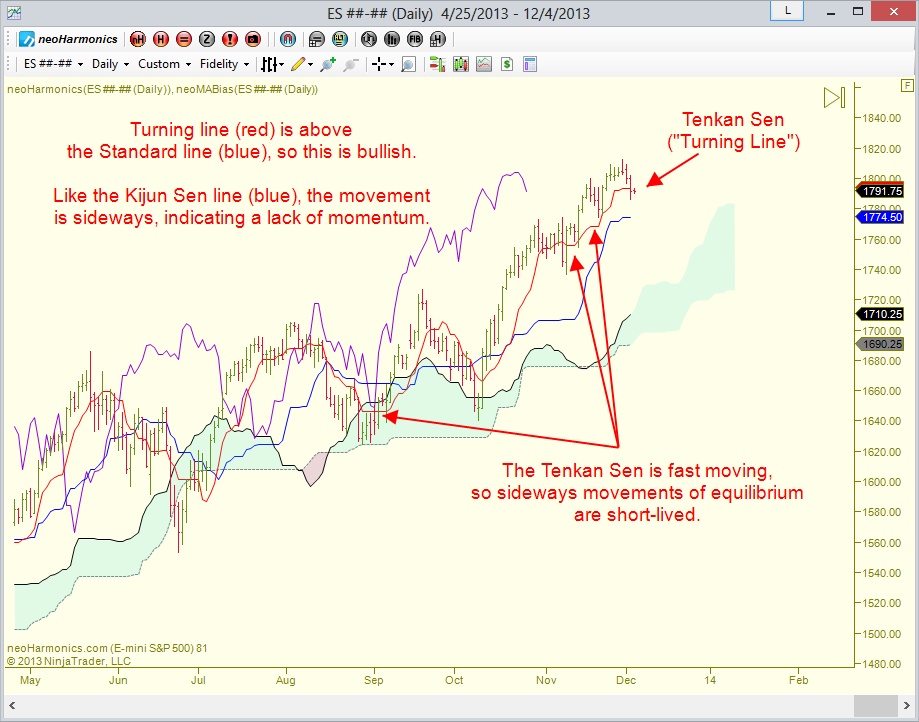

Tenkan Sen (‘Turning Line’, red line)

Usage

Measures short-term trend, provides level of support/resistance, and an indication of short-term momentum.

Unlike a typical moving average this is an average of the highest high and lowest low over a period of time. This can cause the line to go “flat” or sideways, indicating equilibrium. Thus, the angle of the line can be an indication of momentum. A steeply angled line is bullish/bearish, where a sideways line is lacking momentum.

Price closing above/below the line can give an early indication of a trend change. However, due to the fast nature of the line, it must be confirmed by other means.

The turning line and the standard line (mentioned below) are meant to be paired together (red and blue lines).

Kijun Sen (‘Standard Line’, blue line)

Usage

Measures short-term trend, provides level of support/resistance, and an indication of short-term momentum.

The Kijun Sen is calculated the same way as the Tenkan Sen, so they give similar information. However, the Kijun Sen is calculated over a longer period of time and is a slower moving line of the two. Thus, this gives a more reliable indication of short-term trend and momentum than the Tenkan Sen.

The cross of these two lines can provide a signal as well. Tenken Sen above Kijun Sen (red line above blue line) is bullish. Tenken Sen below Kijun Sen (red line above blue line) is bearish.

The turning line and the standard line (red and blue lines) are meant to be paired together (similar to the Senkou Span A/B lines, mentioned below). This is a similar concept to a pairing of a slow and a fast moving average and analyzing their relationship to each other. Because these two lines are used together, there is an option to fill the area between them (like the cloud), discussed later.

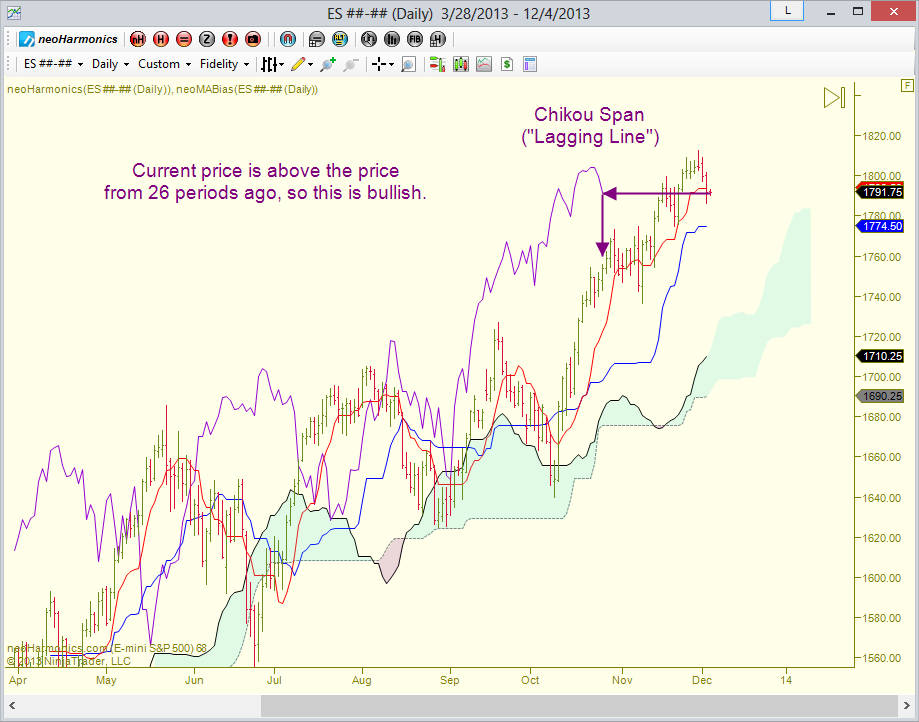

Chikou Span (‘Lagging Line’, purple line)

Usage

Measures medium-term trend.

By time-shifting the current price back by 26 periods, we can see where the current closing price is relative to the past. If the Chikou Span is above the price of 26 periods ago, then it’s bullish. If it’s below, then it’s bearish.

When looking at the relationship of the lagging line and historical prices, it’s important to remember that the lagging line was shifted backward when it was happening in real time.

This is a very important indication of sentiment that should be consulted with every trading decision with this system!

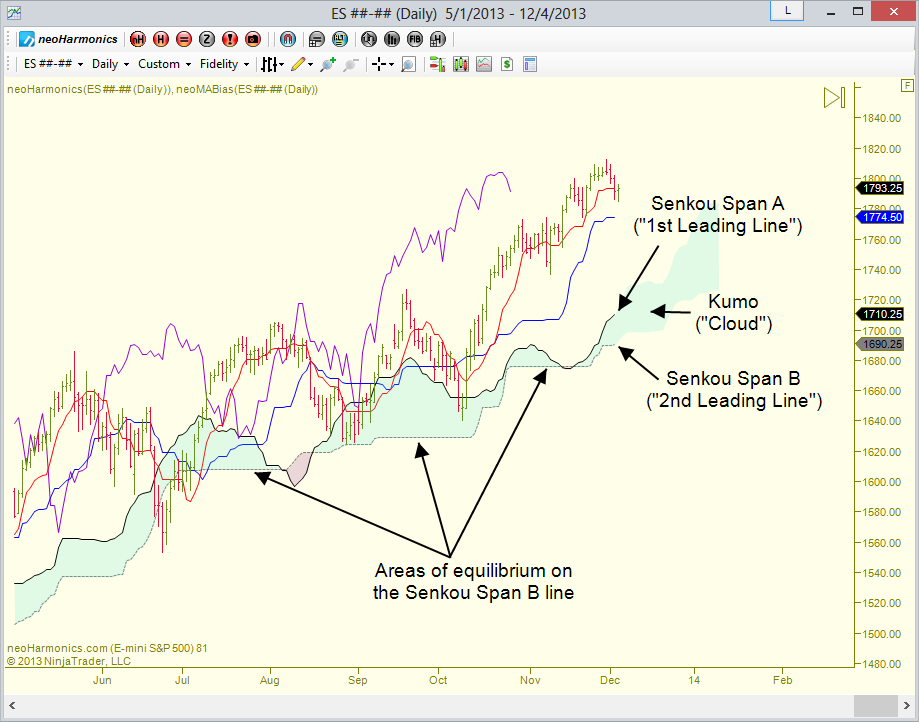

Senkou Span A/B and the Kumo (‘Cloud’)

Usage

Measures longer-term trend, support/resistance, and volatility.

The Senkou Span A is shifted forward 26 periods (1 month), based on an average of the Tenkan Sen and Kijun Sen (red and blue lines).

The Senkou Span B is an average of the Highest High and Lowest Low over 52 periods (2 months), then shifted forward 26 days (1 month). Due to the long period length and the calculation method, this line will see the longest periods of sideways/flat movements (equilibrium).

These are the longest term lines in the system. Together they form the “kumo” or “cloud”, which is the shaded area between the two lines.

Like the “turning” and “standard” lines (red and blue lines), the crossing of these two lines can give a bullish or bearish signal as well. This “cross” is sometimes labeled as a “twist” as it looks like the twisting of a two-sided ribbon.

When price is above the cloud, it’s a sign of bullish sentiment, since current price is higher than the historical average. Conversely, if price is below the cloud, it means there is a stronger bearish sentiment. Finally, trading within the cloud itself is risky, since it means that price is currently in equilibrium. It’s wise to wait for price to leave the middle of the cloud and trade in the newly established trend.

The thicker the cloud, the more volatility and the greater the support/resistance it will provide. The thinner the cloud, the less volatility.

Purchase The Moving Average Pro for NinjaTrader 7

Now that you understand the lines, how can you use them?

As mentioned earlier, all the lines are meant to be used in conjunction with each other. Each strategy outlined below should be used with the overall system’s picture in mind!

When looking at the various components of this system, each piece is telling a different story.

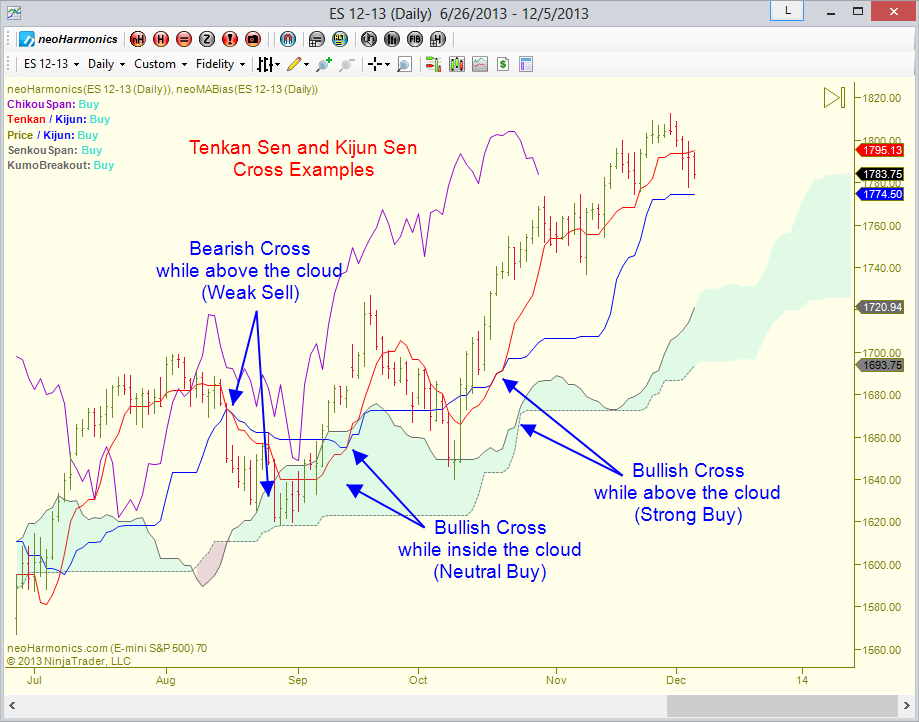

Tenkan Sen/Kijun Sen Cross (‘TK Cross’)

- Strong Buy: Red line crosses above the blue line and the cross itself is above the cloud.

- Weak Buy: Red line crosses above the blue line and the cross itself is below the cloud.

- Neutral Buy/Sell: Cross occurs inside the cloud. Wait for a close outside the cloud (in the direction of the signal) for confirmation.

- Weak Sell: Red line crosses below the blue line and the cross itself is above the cloud.

- Strong Sell: Red line crosses below the blue line and the cross itself is below the cloud.

As always, the position of the Chikou Span (lagging, purple line) must be in agreement with the above signals. For example, if the lagging line is in a bullish position, it can give more strength to a “strong buy” Tenkan Sen/Kijun Sen cross.

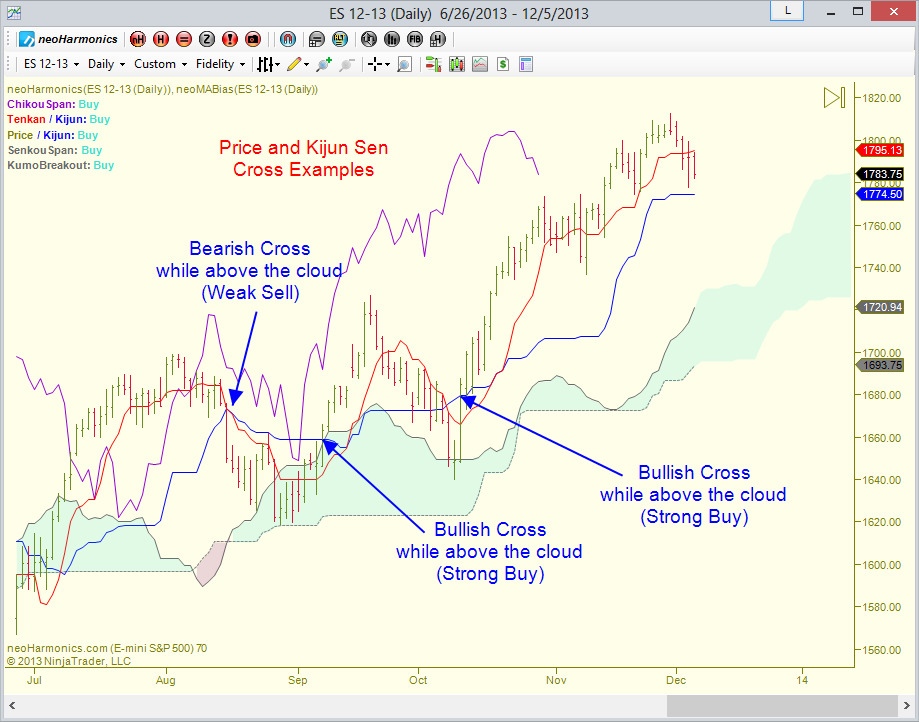

Price/Kijun Sen Cross

- Strong Buy: Price closes above the blue line, which occurs above the cloud.

- Weak Buy: Price closes above the blue line, which occurs below the cloud.

- Neutral Buy/Sell: Cross occurs inside the cloud. Wait for a close outside the cloud (in the direction of the signal) for confirmation.

- Weak Sell: Price closes below the blue line, which occurs above the cloud.

- Strong Sell: Price closes below the blue line, which occurs below the cloud.

Since the Kijun Sen line is a trigger for the trade, it can also act as a stop-loss position as well. Placing your stop a few ticks on the other side of this standard line is a trading idea.

As always, the position of the Chikou Span (lagging, purple line) must be in agreement with the above signals. For example, if the lagging line is in a bullish position, it can give more strength to a “strong buy” price/Kijun Sen cross.

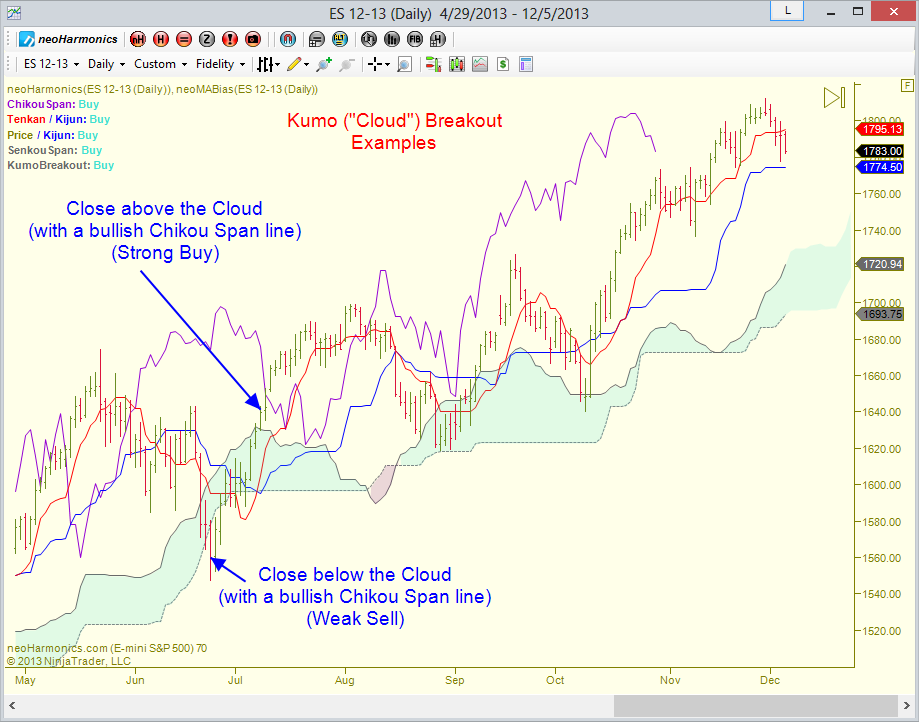

Kumo (‘Cloud’) Breakout

- Buy: Price closes above the cloud (preferably in a bullish trend)

- Sell: Price closes below the cloud (preferably in a bearish trend)

For an additional indication of strength, use the position of the Chikou Span (lagging, purple line) for additional confirmation.

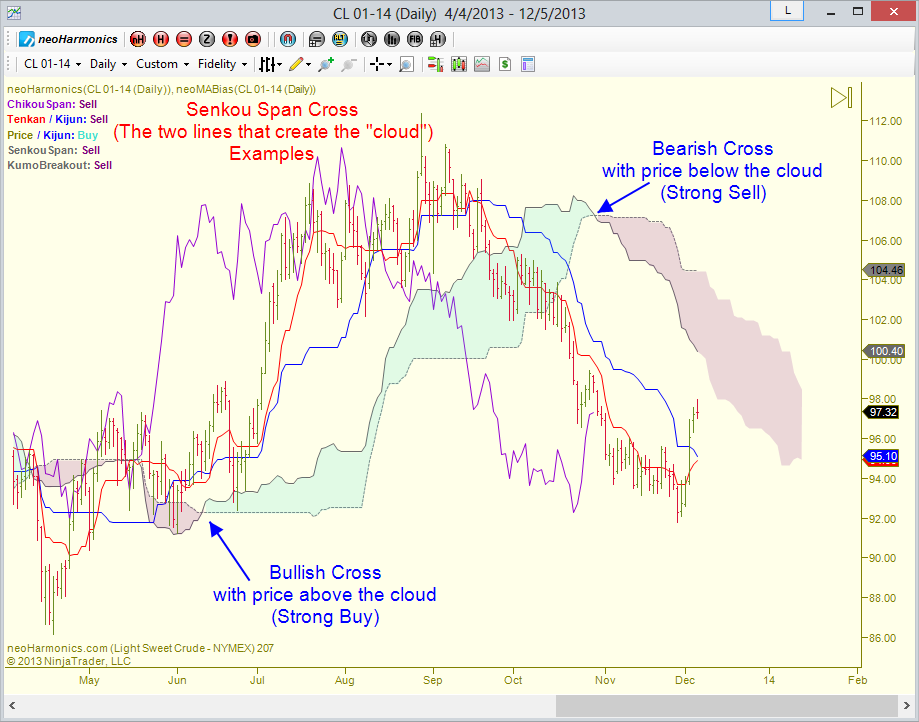

Senkou Span Cross

As mentioned above, the kumo (cloud) consists of Senkou Span A/B. When these lines cross, it can offer a bullish/bearish signal.

- Strong Buy: “A” line crosses above the “B” line and price is above the cloud.

- Weak Buy: “A” line crosses above the “B” line and price is below the cloud.

- Neutral Buy/Sell: Cross occurs when price is inside the cloud. Wait for a close outside the cloud (in the direction of the signal) for confirmation.

- Weak Sell: “A” line crosses below the “B” line and price is above the cloud.

- Strong Sell: “A” line crosses below the “B” line and price is below the cloud.

Since the Senkou Span lines are time-shifted into the future, the cross will happen in front of current price. This is important to keep in mind when looking at historical data. In other words, when the cloud changes colors, the signal actually occurred 26 periods in the past from that point.

As always, the position of the Chikou Span (lagging, purple line) must be in agreement with the above signals. For example, if the lagging line is in a bullish position, it can give more strength to a “strong buy” Senkou Span A/B cross.

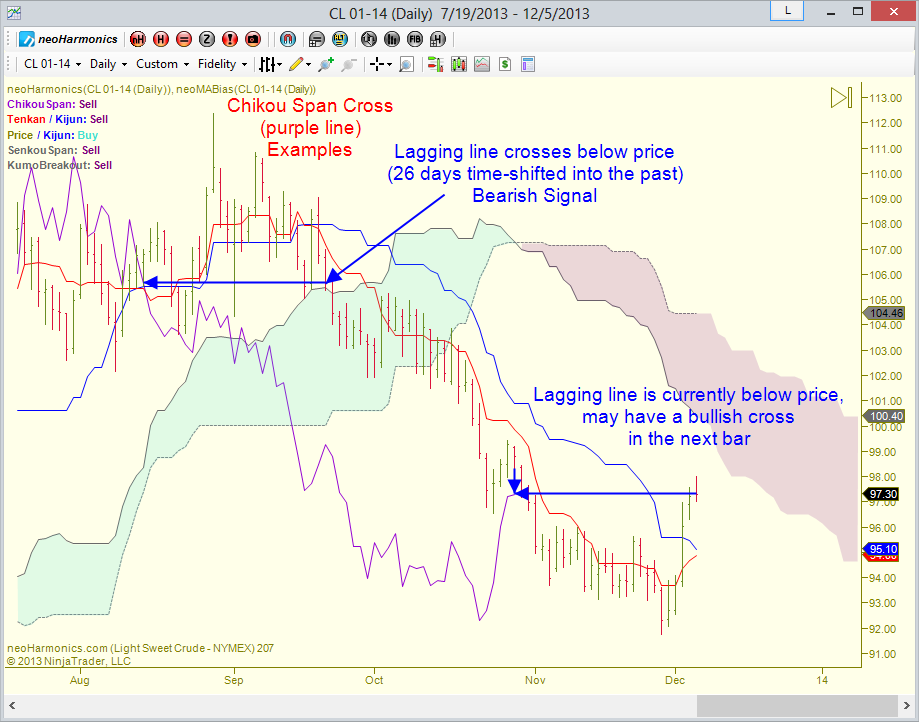

Chikou Span Cross

- Strong Buy: Chikou Span crosses above time-shifted price and current price is above the cloud.

- Weak Buy: Chikou Span crosses above time-shifted price and current price is below the cloud.

- Neutral Buy/Sell: Cross occurs when current price is inside the cloud. Wait for a close outside the cloud (in the direction of the signal) for confirmation.

- Weak Sell: Chikou Span crosses below time-shifted price and current price is above the cloud.

- Strong Sell: Chikou Span crosses below time-shifted price and current price is below the cloud.

Since the Chikou Span line is time-shifted into the past, the cross will happen behind current price. This is important to keep in mind when looking at historical data. In other words, when the purple line crosses price, the signal actually occurred 26 periods in the future from that point.

Summary of Ways this System Indicates Bias:

- Chikou Span (purple) in relation to the time-adjusted price

- Tenkan Sen/Kijun Sen Cross (red/blue cross, Turning Line and Standard Line cross)

- Cloud cross (the two lines that make up the “cloud”)

- Price above or below the Kijun Sen (Standard Line, blue line)

- Price above or below the Cloud

With so many lines, it can look a bit daunting to see what it’s telling you!

To help with this, the Moving Average Pro indicator has the option to display a summary of these statuses, as shown below (and on many of the screenshots above). The words are color-coded based on the color of the line. For example, the Tenkan Sen line is red, while the Kijun Sen line is blue, so their labels reflect that. Further, the “Buy” or “Sell” labels are colored based on the configurable color of the cloud.

To further help with analysis, the Moving Average Pro indicator has the option to fill in the area between the Tenkan Sen and Kijun Sen (red/blue) lines, as shown below.

This helps quickly see where the lines are on the chart and their relative position to each other. Compare the screenshot below to the screenshot above to see how this can help.

Contact Info

Testimonials

-

“I your tools in my day trading routine and I have to admit that it really, really helps me to be a better and profitable trader.

So, thank you for all the hard work you’ve done, it is really appreciated.”

-

“May I say I am enjoying the trial. It is a well thought out software and the best I have seen for [Swing Patterns].”

-

“I could not pass up the opportunity to commend you on the presentation with NinjaTrader Ecosystem and [UppDnn]. Daniel, you have certainly added a dimension to ‘consummate professional.’ I have participated in several sessions of webinars with NinjaTrader and others. Your presentation was the most concise, easy to understand, follow and absorb than any I have seen from anyone. Never did you lean to any type of ‘selling mode’ but rather the most concise explanation of the math and mechanics. You were prepared and focused and made the most ardent use of time management I have seen to date in anyone that represents themselves as knowledgeable of the markets and/or business.

My acquisition of the [UppDnn]coupled with the NinjaTrader has daily expanded into a very strong and unemotional knowledgebase for execution. I wish to express my gratitude for the opportunity to be a participant of your amazing technology application. I am learning constantly and still have much more to accomplish. Simply……Thank you for showing your excellence.”Lauren S.

Customer -

“I greatly appreciate all of the hard work that you both have done over the years to be able to produce such an amazing platform! I cannot describe how easy you guys have just made my trading life become. I really feel like I was just walking around blind for all these years and now you guys have given me the gift of vision. I truly look at the markets in a completely different way.”

“I have been trading for the last 10 years, with varied results, and I have never had such a relaxing day trading as I have today.”

Dave M.

Customer -

“Loving it!! I don’t know how people can trade without this software. Thank you so much for creating it. You made my day!!!”

Patty E.

Customer -

“Thank you for your extensive reply. … I was touched with the effort you took to answer my email. Hence this reply to you.”

Avi M.

Customer -

“As a result of [your explanation] I took a long position that netted me 100 points that I would not have previously taken without this understanding. Your software is helping me to make money every day. I have never seen such a great piece of trading software before.”

“Mate your software is absolutely astonishing. I know I’ve said it before but it’s truly a work of art… It’s mind boggling how I can draw a pattern and price will get within a couple of ticks of the dotted line in the PRZ… I am literally making money with your software every day. I don’t know how I ever traded without it.”

Geoffrey W.

Customer -

“I’ve been with you since 2012 and have appreciated everything you have done along the way – I use your tools on both NinjaTrader 7 and NinjaTrader 8 every day and consider you as one of the best programmers out there. Thanks for everything you have done !!”

Eric M.

Customer -

“I think I may have “greatly” underestimated the power of the Symmetry tool. Your ease of use of that tool is amazing.”

David C.

Customer -

“Thanks mate. Amazing tool. Glad I found it.”

Basilius L.

Customer -

“Your updated Market Profile is absolutely fabulous! It installed without a hitch and I’m already making money with it. ” “I’ve come to expect that all of your stuff is simply top notch. From your website to your workbooks to your new video, even a dummy like me can understand it (mostly). While I still have a tremendous amount to learn, I’m on my way to becoming a better trader. I credit you for a good deal of my success. Thank you, Sir. I appreciate you looking out for me. Market Profile is turning out to be a nice feather in my cap. ”

“You already know I’m a big fan. I can’t help but to repeat myself – I am thoroughly enjoying your work dealing with market profile. Until now, MP has always been vexing to me. I’ve witnessed numerous “interpretations” as to how to use MP. All of which either left me scratching my head or didn’t lead to consistent results. Your indicator and instructional video has taken what used to be a mystery and turned it into an asset. The double distribution piece is especially valuable. Thank you. ”

Darrell D.

Customer -

“I have seen (and coded) A LOT of stuff. By far, [UppDnn] is the best I have seen. Whoever does your marketing and web site design is VERY professional. I have looked at all the other NinjaTrader partners who sell Fib/Pattern stuff. In my opinion, yours is the best in both presentation and product. Good job!”

Paul S.

Customer -

“The [UppDnn] Pro Suite has been an eye-opener for me and a guide in my trading plans. Sincerely, it will be hard trading a day without it.”

Adegeji A.

Customer -

“I enjoy your software every single day I work with it. It’s my favorite and ever since I bought it, I have had no need to buy any other!”

Patty E.

Customer